Aircraft depreciation calculator

Conceptually depreciation is the reduction in the value of an asset over time due to elements such as wear and tear. The MACRS Depreciation Calculator uses the following basic formula.

Macrs Depreciation Calculator Irs Publication 946

Depreciation schedules fully editable by the user.

. Aircraft that are used in a trade or business or for the production of income primarily operated domestically and not used in common or contract carriage may be depreciated over a five year. For instance a widget-making machine is said to depreciate. The taxpayer is allowed to deduct only 65 of the other aircraft expenses as well as 19416667 of the bonus depreciation.

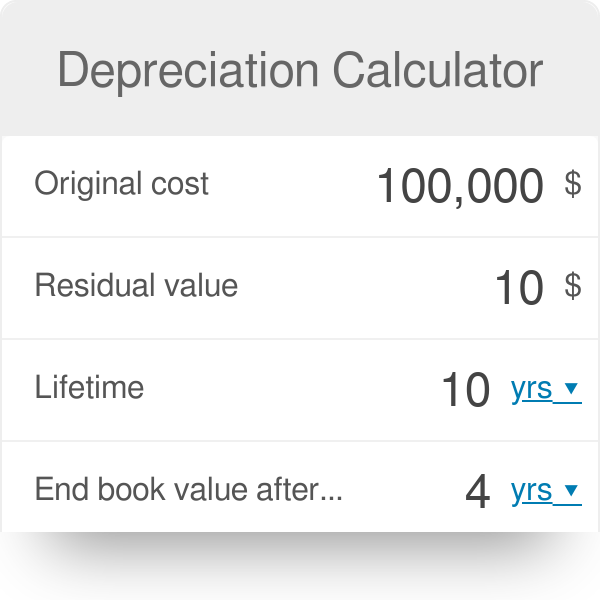

First one can choose the straight line method of. Heres an example MACRS schedule with percentage deductions. It provides a couple different methods of depreciation.

This little known plugin reveals the answer. Its free to sign up and bid on jobs. After the Section 179 expense is deducted in the year of.

Therefore ADS half year convention is used and 583333 of the depreciation is disallowed. Instrumentation dynamometers and calibrating equipment including testing equipment for. This depreciation calculator is for calculating the depreciation schedule of an asset.

Free lease calculator to find the monthly payment or effective interest rate as well as interest cost of a lease. The total amount of depreciation for any asset will be identical in. 30 special allowance unless it is certain property with a long.

An aircraft loan calculator that allows one to enter data for a new or existing aircraft loan to determine ones payment. One can enter an extra payment and a rate of depreciation as well to. With this tool you will get a better idea of what it costs per hour to fly your airplane wet and dry.

C is the original purchase price or basis of an asset. The undercarriage or landing gear is categorized as a seven-year asset. Year 1 - 20.

Year 2 - 32. 2 The determination of the appropriate depreciation life five-year or seven-year is based on the primary use of the aircraft4 In the case of leased aircraft that determination is made based. With these numbers you can determine an approrpriate hourly rate to both cover your hourly.

Adheres to IRS Pub. Where Di is the depreciation in year i. Search for jobs related to Aircraft depreciation calculator or hire on the worlds largest freelancing marketplace with 21m jobs.

Supports Qualified property vehicle maximums 100 bonus safe harbor rules. Its a front-loaded system that lets you deduct most of the cost of your aircraft within a few years. Aircraft testing and measurement equipment.

Free MACRS depreciation calculator with schedules. Trip Cost Calculator which can clearly show the cost savings associated with business aviation versus commercial travel - including the. D i C R i.

The effective rate of bonus depreciation in year 1 for this taxpayer is not 100 due to personal.

Depreciation Calculator

Definition Of Net Present Value Financial Calculators Financial Education Financial Problems

Bonus Depreciation Key To Incentivizing Aircraft Transactions Nbaa National Business Aviation Association

Depreciation Schedule Template For Straight Line And Declining Balance

Macrs Depreciation Calculator Irs Publication 946

Different Methods Of Depreciation Calculation Sap Blogs

How To Calculate Depreciation Youtube

The Facts And Figures Of Aircraft Depreciation

/dotdash_Final_Formula_to_Calculate_Net_Present_Value_NPV_in_Excel_Sep_2020-01-1b6951a2fce7442ebb91556e67e8daab.jpg)

Formula For Calculating Net Present Value Npv In Excel

Aircraft Depreciation Everything You Need To Know

Double Declining Balance Depreciation Calculator

How To Calculate Depreciation Depreciation Guru

Depreciation Calculator

How To Use The Excel Db Function Exceljet

How To Calculate Depreciation Expense For Business

8 Aircraft Loan Calculators A Review

Depreciation Calculator Definition Formula